February 2, 2023

- Categories:

- Bankruptcy

Are you on the brink of losing your vehicle because you’ve defaulted on the loan? Filing Chapter 13 bankruptcy may be the saving grace that keeps you behind the wheel.

Keep reading to discover how this powerful financial tool can help you avoid repossession and get back on the road to financial freedom.

How does Chapter 13 bankruptcy work?

Repossession can be a stressful and even embarrassing situation, but it’s important to know that you have options. By filing for Chapter 13 bankruptcy, you may be able to create a repayment plan to pay off your debts over a three to five-year period. Moreover, you can use the Chapter 13 bankruptcy process to lower the car payment’s interest rate, if the trustee agrees.

How can you create a repayment plan under Chapter 13 bankruptcy?

By filing for Chapter 13 bankruptcy, you can stop repossession in its tracks. The instant you file, an automatic stay goes into effect. This means that all collection actions, including repossession, will stop immediately.

After filing for bankruptcy, you’ll work with a trustee to create a repayment plan. This plan will include your car loan, and as long as you stay current on your payments, you’ll be able to keep your vehicle.

Chapter 13 bankruptcy also allows you to catch up on missed car payments over the repayment plan. This means you may be able to get caught up on missed payments and avoid repossession altogether.

Consider seeking legal guidance

Chapter 13 bankruptcy is a powerful tool that can help you keep your vehicle and get back on track with your car payments. However, filing for Chapter 13 bankruptcy is a big decision. For this reason, consider seeking legal guidance to help you keep your car and prevent repossession.

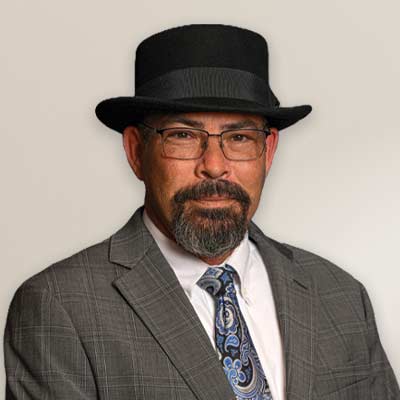

Attorney Brad Hawley possesses years of practical experience focused on bankruptcy, civil and criminal defense. He has prosecuted and defended clients in state court, and is a former enlisted member of the United States Army. Brad is driven by his desire to help people that have been hurt by the legal system, and is dedicated to fixing injustices he sees around him. [

Attorney Brad Hawley possesses years of practical experience focused on bankruptcy, civil and criminal defense. He has prosecuted and defended clients in state court, and is a former enlisted member of the United States Army. Brad is driven by his desire to help people that have been hurt by the legal system, and is dedicated to fixing injustices he sees around him. [