June 29, 2023

- Categories:

- Bankruptcy

When taking out some form of loan or line of credit, it will generally either be considered unsecured or secured debt.

The difference between the two comes down to a simple thing: security. When signing up to a secured lending agreement you’re usually required to have collateral backing it.

It can be difficult to understand what types of debt are secured or unsecured and how they are different.

Unsecured vs secured debts – what’s the difference?

As briefly mentioned above, and as the name suggests, it all comes down to whether a form of security is needed from the borrower.

With unsecured borrowing, the decision of whether or not to lend comes down to creditworthiness. This involves looking at a borrower’s credit score and affordability.

Credit cards are, on the whole, a form of unsecured borrowing. In exchange for riskier borrowing, lenders will charge you a higher rate of interest on the money you owe.

Secured debts, on the other hand, are considered “safer” by the lender as they have something to use to repay the debt in the event of default by the borrower.

Common types of secured debt people have include mortgages and auto loans.

Are there secured credit cards?

There are some secured credit cards available. For one of these cards, you put forward a security deposit and are usually offered a low credit limit to match that deposit. They’re designed to help people with a low, or no, credit score to improve their credit rating.

Having credit card debt can be worrying and it can be difficult to see a light at the end of the tunnel. If you’ve found yourself in a position where the debt is unmanageable, experienced legal guidance can help you find a solution.

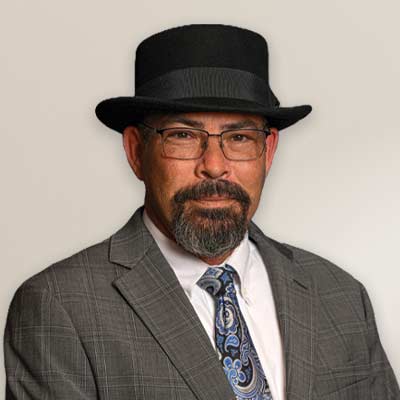

Attorney Brad Hawley possesses years of practical experience focused on bankruptcy, civil and criminal defense. He has prosecuted and defended clients in state court, and is a former enlisted member of the United States Army. Brad is driven by his desire to help people that have been hurt by the legal system, and is dedicated to fixing injustices he sees around him. [

Attorney Brad Hawley possesses years of practical experience focused on bankruptcy, civil and criminal defense. He has prosecuted and defended clients in state court, and is a former enlisted member of the United States Army. Brad is driven by his desire to help people that have been hurt by the legal system, and is dedicated to fixing injustices he sees around him. [